“Start investing smartly now and secure your retirement. Small steps today, big gains tomorrow!”

Smart investing for retirement: How to start now

Retirement is the stage of our life when we want to relax and enjoy our hard-earned time. But comfort and security can be enjoyed only when we plan and invest in advance. I have seen from my own experience that if you start investing in advance, retirement becomes much easier mentally and financially.

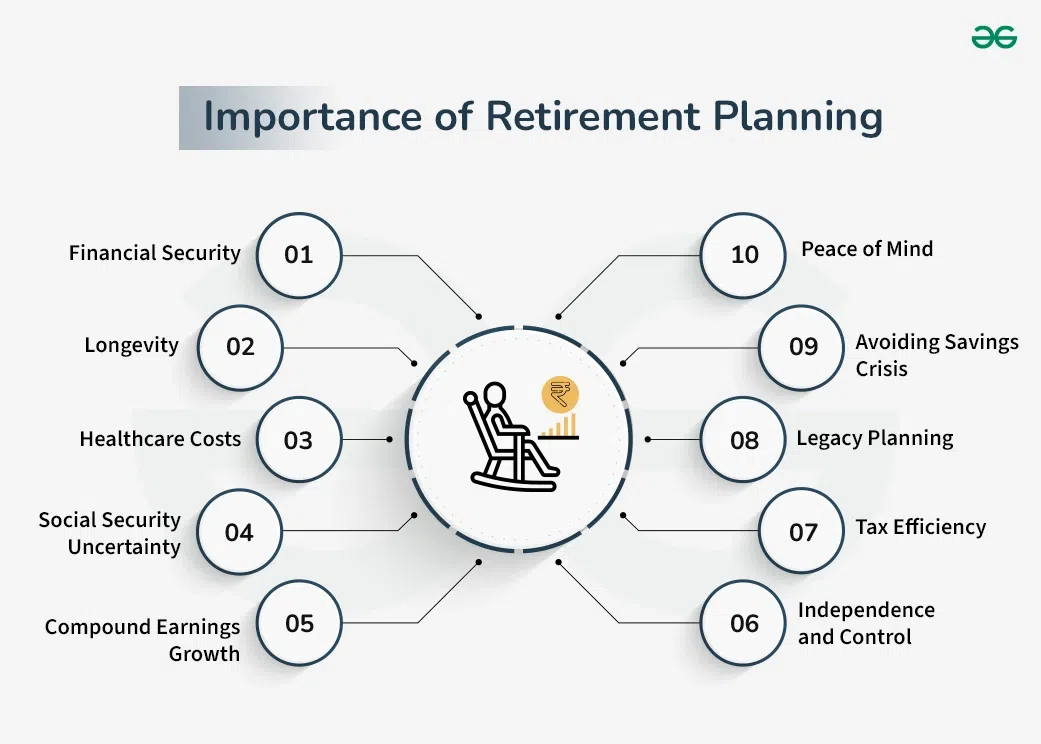

Why retirement investing is important

By the time we retire, we no longer have a regular working income. Retirement can be a very challenging time if we have not planned our money in advance. I myself started investing in my 25th year and today I feel a mental security that I have enough savings for the future. Investing for retirement is not just a way to save money, but it is a way to secure our future.

Understand your needs

Before you start investing, it is important to know how much money you will need at the time of retirement. This should not be just an estimate but should take into account your lifestyle, expenses and possible future medical expenses.In my first investment, I kept in mind that there should be enough money left for children’s education, family’s health and my own comfort. When you understand your needs, you can choose the right investment option and avoid unnecessary risk.

Investment options

There are many investment options available for retirement. From my experience, I have found that choosing the right option is of utmost importance.

Mutual Funds

Mutual funds are a great option for long term investment. In this, you can get big returns over time by making small investments. I started a SIP plan in my first investment. Initially it seemed like a small investment but over time its benefit became huge. Mutual funds also give you the opportunity to take advantage of the fluctuations in the market.

PPF (Public Provident Fund)

PPF is the best option for safe investment. It keeps your money safe and also provides tax benefits. I opened a PPF account in my first job. This investment gives very good returns in the long term and it became a major part of my financial security in retirement.

Stocks and equities

Stocks and equity investments can be a little risky but can give good returns in the long run. I started investing in stocks slowly and my market knowledge helped me. It is important to be patient in stocks as don’t sell too quickly and think long term.

Real estate and gold

Real estate and gold are also good investment options for retirement. They diversify your investments and reduce risk. I added some gold and real estate to my investments and it started paying off over time. The advantage of gold is that it retains value even during inflation.

Right time to start investing

The sooner you start investing, the better. In my experience, even if you start with a small investment, the benefits of compounding in the long run are huge. I always say start now, even if the amount is small.The value of your investments will grow over time and serve as the cornerstone of your retirement security.

Constant evaluation and revision

Just starting investing is not enough.Review your investments periodically and make adjustments as needed.I have observed that when we keep a track of our investments and make necessary adjustments on time we get higher returns.If a plan is not working properly, do not hesitate to change it.

Restraint and patience

Patience is very important in investing. Making decisions in haste can lead to losses.I have found that patience and self-control make investing safe and profitable.Invest for the long term, be aware of market fluctuations and stay focused on your goal.

conclusion

Investing wisely for retirement is not as difficult as it seems. Just make a plan, decide on the best investment options, understand your needs and review it regularly.

#retirement #investment #finance#Anslation#CarrerBook #moneymanagement #smartinvesting #futuresecure

Leave a Reply